To nail the right price for a home, you have to start with a rock-solid Comparative Market Analysis (CMA). This isn't just about pulling a few numbers; it's about digging into recently sold, active, and pending listings of similar homes nearby to find a credible price range. Getting this step right takes the guesswork out of the equation and gives you a logical, data-backed foundation for the price you recommend.

Building Your Foundation with a Comparative Market Analysis

The secret to accurate pricing isn’t a gut feeling—it’s a meticulously prepared CMA. Think of it as building a case. You're not just finding a price; you're crafting a data-driven story that will convince your sellers, and later, potential buyers and their agents, that the number is right. A strong CMA is the unshakable bedrock of your entire pricing strategy.

A weak or rushed analysis, on the other hand, can spell disaster. Overpricing by even 5-10% almost always leads to a price cut down the road, which can stigmatize the listing and make buyers suspicious. In fact, properties priced within 5% of their final sale price made up 60% of quick sales (under 30 days), while only 20% of homes needing price reductions sold that fast. Realtor.com has some great data on this.

Zero In on Geographic Proximity

The first rule of a powerful CMA is "location, location, location"—but you have to get much more specific than the city or zip code. Drill down to the exact subdivision, neighborhood, or even a tight radius of a few blocks. A home just a mile away might as well be in another state if it's across a major highway or in a different school district. It's not a true comp.

You have to think like a buyer. What other homes would a person looking at your client's property also consider? The real market boundaries are often invisible lines drawn by things like:

- School district lines: This is a huge value driver, and crossing that line can mean a five or six-figure price difference.

- Neighborhood perks: Is it close to the park, the new grocery store, or the train station? Those things matter.

- Architectural vibe: A pocket of charming historic homes holds a different value than the new construction development right next to it.

Stick to a Recent Timeframe

Real estate moves fast. A sale from last year is ancient history and tells you almost nothing about what the market will bear today. You really need to keep your focus on sales from the last 3-6 months. That window gives you the most accurate snapshot of what buyers are doing right now.

A price is a signal to the market. Using old data sends the wrong signal, suggesting your client is out of touch with today’s reality. Your CMA must reflect the market as it is right now, not as it was last year.

Now, if you're in a sleepy market with very few sales, you might have to stretch that timeframe to 9 or even 12 months. Just be ready to make some serious adjustments for market appreciation or depreciation over that period. The more recent your comps, the more defensible your price will be. These principles are pretty universal in real estate valuation, and you can see similar logic in our guide on how to price a rental property.

Analyze the Three Listing Statuses

A truly comprehensive CMA looks beyond just what has already sold. To get the full picture, you need to analyze all three categories of market activity. Each one tells a critical part of the story.

- Sold Listings: This is your gold standard. These are the hard-and-fast numbers showing what buyers have actually been willing to pay for similar homes. It’s the bedrock of your entire valuation.

- Active Listings: This is your direct competition. Looking at these tells you what other sellers are asking, what the inventory looks like, and how to position your listing to stand out. Is the market flooded, or is your client’s home a rare gem?

- Pending Listings: These are homes that are already under contract. While you won't know the final sale price until it closes, the list price is a fantastic real-time indicator of what price point is successfully attracting offers in today's market.

Selecting and Adjusting Your Comps Like a Pro

Once you've pulled an initial list of comparable properties, the real work begins. This is where the science of data meets the art of interpretation. Anyone can run a basic search, but a truly accurate price comes from digging deeper and understanding the story behind the numbers.

You might start with ten potential comps, but you'll quickly realize only a handful are truly relevant. The goal is to whittle that list down to the three to five best examples that genuinely mirror your client's home. This hand-picked selection is the foundation of a pricing strategy you can confidently stand behind.

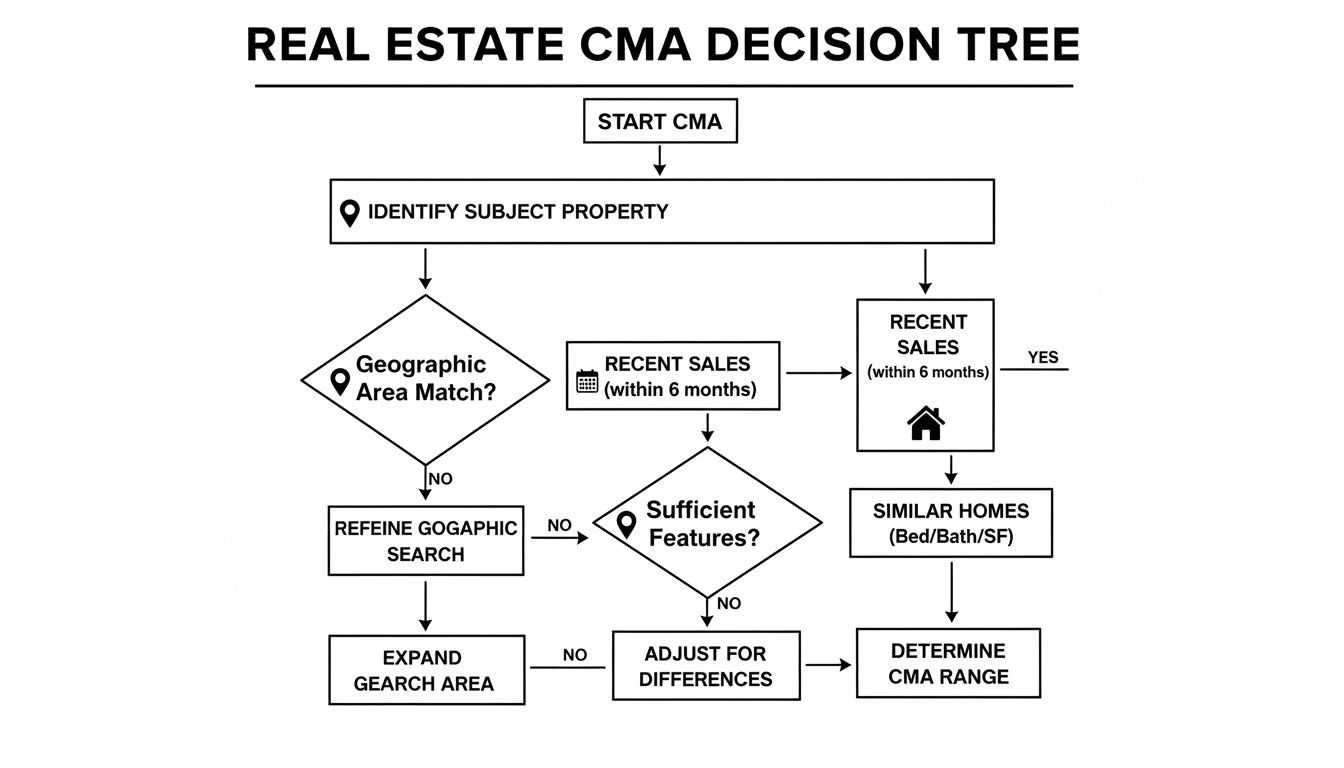

This flowchart lays out the basic filters—location, recency, and property type—that help you make that first big cut.

Think of these as your non-negotiables. Nail these down first, and you'll save yourself a ton of time before you get into the nitty-gritty of adjustments.

Making Defensible Dollar-Based Adjustments

No two homes are ever identical, which is why adjustments are so critical. This is how we turn subjective differences into objective, justifiable figures that support the final list price. It's about making logical, dollar-based changes for any significant feature that sets your client's home apart from the comps.

It all starts with using your client's home as the baseline. From there, you'll systematically adjust the sale price of each comp up or down.

- If a comp is superior to your subject property (maybe it has an extra bathroom or a pool), you subtract value from its sale price.

- If a comp is inferior (it has a smaller garage or an older kitchen), you add value to its sale price.

This process helps you answer the million-dollar question: "What would this comparable property have sold for if it had the exact same features as my client's home?"

Quantifying Key Property Differences

Putting a dollar amount on a feature takes real local market knowledge. A pool is worth a lot more in Miami than it is in Seattle, right? The value of any given feature can swing wildly depending on where you are, but there are some common adjustment areas you'll see in almost every CMA.

Take a finished basement, for example. If a comp with an unfinished basement sold for $500,000, but your client’s home has a beautifully finished one, you need to account for that. A solid starting point is to check local cost-value reports or see what local appraisers are valuing that space at—often somewhere in the $30-$50 per square foot range, depending on the quality of the finish.

Here’s how that plays out in a real-world scenario. Your subject property is a 3-bed, 2.5-bath home. A nearby comp, which sold for $520,000, is almost identical but only has 2 full baths.

Scenario: In your market, a half-bath typically adds about $5,000 in value. Because the comp is inferior (it's missing that half-bath), you would add $5,000 to its sale price. The new, adjusted value for that comp is now $525,000.

You can apply this same logic to everything from a new roof to a premium corner lot. A stunning kitchen remodel might justify a $15,000-$25,000 adjustment over a dated kitchen straight out of the 90s. The secret is to be consistent and have a solid reason for every single adjustment you make.

To help with this, I've put together a quick guide for common adjustments. Remember, these are just examples—your local market data is always the final authority.

Comparable Property Adjustment Guide

| Feature/Condition | Value Adjustment Range (Example) | Rationale |

|---|---|---|

| Extra Half-Bath | +$3,000 to +$8,000 | Reflects the cost and convenience of an additional bathroom. |

| Modern Kitchen Remodel | +$15,000 to +$30,000 | Accounts for the significant buyer appeal and cost of a new kitchen. |

| Finished Basement (per sq. ft.) | +$30 to +$50 | Adds value for the extra livable space compared to an unfinished area. |

| In-ground Swimming Pool | -$5,000 to +$20,000 | Highly market-dependent; can be a liability or a major asset. |

| Lack of Central A/C | -$5,000 to -$10,000 | A significant negative adjustment in markets where A/C is standard. |

| Backing onto Busy Road | -$10,000 to -$30,000+ | Location-based adjustment for noise and desirability. |

This table illustrates how you can build a logical framework for your adjustments, ensuring your final price recommendation is built on data, not guesswork.

Spotting and Discarding Outlier Properties

Just as important as making good adjustments is knowing when to toss a comp out completely. Outliers are data points that can poison your entire analysis and send you down the wrong path with pricing. An outlier is a property that, despite looking similar on paper, sold for a price that's way higher or lower than everything else.

These wild swings in price are usually caused by special circumstances:

- A distressed sale: A foreclosure, short sale, or a quick sale due to divorce can pull the price well below market value.

- An all-cash, quick-close buyer: Sometimes a buyer overpays simply to get the deal done fast, without financing hurdles.

- Unique property features: The home might have a one-of-a-kind view that adds a huge premium, or it could back up to a noisy gas station, tanking its value.

If you find that one comp’s adjusted value is 10-15% (or more) out of sync with the others, that’s a massive red flag. Do a little digging to see if you can figure out why, but don't hesitate to discard it. One of the biggest mistakes you can make is trying to force a skewed data point to fit. Stick with the comps that tell a clear, consistent story about the market.

Choosing the Right Pricing Strategy

You've done the heavy lifting with your CMA and have a solid value range. Now comes the real strategy conversation. Do you go for a quick sale or hold out for the absolute top dollar? This decision is everything—it sets the tone for the entire listing process. Your job is to lay out the options so your client can choose the path that feels right for them.

There’s no magic formula here. The best move always depends on the house itself, the current feel of the market, and your seller's personal situation. Are they in a hurry? Do they have a number in their head they just can't go below? Your role is to walk them through the pros and cons of each play, so you can move forward as a team.

The Market-Speed Pricing Approach

This is all about creating a buzz. You price the home right at, or even a little below, what the comps suggest for fair market value. I know, it can sound crazy to a seller who wants to maximize their profit. But in the right market, it’s a killer tactic. The goal isn't to give the house away; it's to get a flood of buyers through the door on day one.

When a great-looking home pops up with an attractive price, it creates instant urgency. You get a packed open house, a flurry of showing requests, and hopefully, multiple offers. That's when the magic happens—competition can drive the final sale price well above what you even asked for. It’s a classic bidding war scenario.

This strategy is perfect for sellers who value speed and certainty. Maybe they’re moving for a job or have already bought their next house. For them, a fast, guaranteed closing is worth more than gambling for a few extra thousand dollars. In my experience, strategically underpricing by just 1-3% in a hot market can generate offers that land between 98-102% of your target value. That's a far cry from the 85-90% you might get after a painful price drop. For more on market dynamics, check out the latest housing market trends on CBS News.

The Premium Pricing Strategy

Now, for the flip side. A premium pricing strategy means you’re aiming high, listing at the very top of your CMA range—or maybe even pushing past it. This isn't a move for your average tract home. You only play this card when you have something truly special.

We're talking about properties with features that are hard to replicate:

- Stunning, one-of-a-kind architecture

- Unbeatable, protected views

- A prime lot in the most desirable neighborhood

- A recent, no-expense-spared custom remodel

A premium pricing strategy is a bet on uniqueness. You're signaling to the market that this property is special and worth waiting for the right buyer who recognizes and is willing to pay for that distinction.

Patience is the name of the game here. The buyer pool is tiny, and the home will almost certainly take longer to sell. You need a rock-solid marketing plan to back up the price tag. This means investing in professional photos, a cinematic video tour, and a listing description that tells a compelling story. It's a high-risk, high-reward approach that demands a confident seller and an agent who can artfully justify every dollar of that asking price.

Factoring in Home Condition and Market Shifts

A home’s value isn’t set in stone. It’s a moving target, pushed and pulled by its physical state and the ever-changing economic climate. A meticulously crafted CMA gives you a solid starting point, but that's all it is—a start. From there, you have to adjust for the realities on the ground.

This is where art meets science. Translating a property's condition into a tangible price adjustment is a skill you hone over time. You have to move beyond a simple checklist and really see the house through a buyer's eyes, assessing everything from the age of the HVAC to the quality of that fresh paint job. And all the while, you need to keep one eye glued to what the market is doing right now.

Getting Real About the Home’s Physical Condition

Buyers aren’t just purchasing square footage; they’re buying a home’s current state of repair and its future potential. Your pricing strategy absolutely has to reflect this. A brand-new roof is a huge selling point that can justify a higher price, while a 20-year-old water heater is a liability that buyers will mentally subtract from their offer.

I find it helps to create a systematic inventory of the home's core components, noting their age and condition.

- Major Systems: How old are the HVAC, plumbing, and electrical? A system that’s on its last legs can easily become a $5,000-$15,000 price objection for a buyer.

- Roof and Exterior: When was that roof last touched? Is the siding holding up, or is it showing its age? These are big-ticket items.

- Kitchen and Baths: Are these spaces updated and functional, or are they screaming for a gut renovation? A modern kitchen adds serious value, but a dated one can be a major turn-off.

- Cosmetics: Don’t forget about the flooring, paint, fixtures, and overall curb appeal. They may seem like smaller items, but together they create that all-important first impression that heavily influences a buyer’s perception of value.

When you’re trying to pin down the financial impact of needed repairs or potential upgrades, a good remodel cost estimator can be a lifesaver. It helps ground your adjustments in real-world numbers, not just guesswork.

Reading and Reacting to the Market

A house doesn't exist in a bubble. The broader market is constantly exerting pressure on its value, and pricing a home without this context is one of the biggest mistakes an agent can make. You have to understand the local economic story and how it’s shaping buyer and seller behavior today.

Is local inventory suddenly surging? A more competitive price might be the only way to get noticed. Did a major company just announce a new headquarters nearby? That could signal a coming wave of demand, justifying a more ambitious asking price.

A great price reflects a perfect balance between a home's intrinsic value and its position within the current market. Ignoring one for the other leads to a listing that either languishes on the market or leaves money on the table.

In a market that's in flux, getting the price right from the start is crucial to keep the days-on-market from creeping up. We're seeing this play out right now. For-sale inventory is up nearly 9% year-over-year, creating a more balanced market where prices in some major U.S. cities are even expected to dip. This data just underscores why your pricing has to be dynamic.

Building a Dynamic Pricing Model

Think of your final price recommendation as a fluid calculation, not a number you set and forget. You start with the CMA value and then carefully fine-tune it based on the home's specific condition and the current market temperature.

Here’s a quick scenario: Your CMA suggests a value of $450,000. But, the home desperately needs a new roof (a $10,000 job), and you’ve seen a 15% spike in local inventory over the last 60 days.

- Condition Adjustment: First, you account for the roof. You might subtract that $10,000 cost, bringing the adjusted value down to $440,000.

- Market Adjustment: Now, to stay competitive in a softening market, you might recommend pricing just under that, say at $435,000. The goal is to drive immediate interest and avoid the dreaded price reduction down the road.

This approach shows how to blend hard data with real-time market intelligence. A deep understanding of these moving parts is also key when clients ask you how to sell a house faster, because nothing drives a quick sale like a smart, strategic price. When you can present a number that acknowledges both the home's pros and cons alongside market realities, you build incredible trust with your client and set everyone up for a win.

How Premium Marketing Justifies Your Price

You've done the hard work and landed on the perfect price. But that's only half the battle. Now, you have to make the market believe it. This is where your marketing strategy stops being an expense and becomes your single best tool for defending that price tag. High-quality marketing doesn’t just show a house; it builds a perception of value that draws in serious buyers and keeps the lowball offers at bay.

You're not just listing features; you're telling the home's story. It's all about forging an emotional connection before a buyer even thinks about booking a showing.

From Photos to Storytelling

Think of your marketing materials as the evidence that backs up your price. Grainy smartphone photos scream "bargain bin" and practically invite buyers to haggle. On the other hand, professional, beautifully lit visuals immediately communicate that this is a premium property worth every penny.

The investment here is a no-brainer. A standard professional photoshoot might cost around $230 on average, but the perceived value it adds is immense. To really build buyer confidence and set your listing apart, professional floor plans and photography are your secret weapon. They offer total clarity and help buyers mentally move their furniture in.

This is absolutely critical if you've opted for a premium pricing strategy. Your marketing has to scream quality to attract buyers who appreciate unique details and are willing to pay for them. By showcasing a home's best side with compelling visuals, you aren't just selling a property—you're proving the price is right.

Leveraging Video to Build an Emotional Connection

In today's market, great photos are just the ticket to the game. Cinematic video tours are what actually win it. A well-produced video creates a dynamic, immersive experience that static images simply can't match, building that crucial emotional bridge between a buyer and the home.

Consider the difference. A photo of a kitchen is nice. A video that glides smoothly from the quartz countertops to the sun-drenched breakfast nook, on the other hand, sells a lifestyle. This is how you justify that higher price point.

Strategic marketing isn't an expense; it's a vital tool for achieving your client's financial goals. Every dollar spent on high-quality visuals is an investment in defending the asking price and maximizing the final sale.

The good news is you don't need a Hollywood film crew anymore. Modern tools can transform your professional photos into slick, engaging video content in minutes, elevating every single one of your listings. By creating a consistent, high-end brand identity, you signal to the market that your listings—and your pricing—are top-tier.

Crafting a Narrative in Your Listing Description

Your visuals pull buyers in, but the property description is where you reinforce the value and seal the deal. This is where your pricing and marketing stories have to align perfectly. Don't just list facts—weave a narrative.

Instead of a dry "3 bedrooms, 2 baths," try something that paints a picture: "Unwind in a serene primary suite, complete with a spa-like ensuite bath."

Use descriptive, evocative language that helps buyers truly imagine themselves living in the space. This is also a powerful thing to demonstrate in your real estate listing presentation template; it shows sellers exactly how you’ll market their home to get the best possible outcome.

A well-written narrative should always:

- Highlight Unique Features: Point out the custom built-ins, the mature oak tree shading the backyard, or the way the morning sun floods the kitchen.

- Sell the Lifestyle: Focus on benefits, not just specs. Talk about weekend barbecues on the deck or cozy evenings by the fireplace.

- Match the Price Point: The tone and language for a luxury estate should feel more refined and elegant than for a starter home.

The right marketing assets do more than just showcase a property; they build a case for its value. The following table breaks down how different assets can influence a buyer's perception and support your asking price.

Marketing Asset Impact on Perceived Value

| Marketing Asset | Impact on Buyer Perception | AgentPulse Application |

|---|---|---|

| Professional Photography | Communicates quality and care. A well-shot home is seen as a well-maintained home. | Turn high-res photos into dynamic, attention-grabbing video content. |

| Cinematic Video Tours | Creates an emotional connection and helps buyers envision the lifestyle the home offers. | Generate polished video walk-throughs in minutes to make listings feel more immersive and valuable. |

| Detailed Floor Plans | Provides clarity and confidence. Buyers can visualize furniture placement and flow. | Include floor plan images within your video narrative to give a complete picture of the space. |

| Compelling Descriptions | Weaves a story that highlights unique features and sells the experience of living there. | Use AI-powered writing tools to craft elegant, benefit-driven narratives that match the premium visuals. |

By combining stunning visuals with a powerful story, you create a marketing package that presents a valuable opportunity, not just a house. This comprehensive approach builds buyer confidence, minimizes the urge to haggle, and ultimately justifies the price you've worked so hard to determine.

Common Questions About Pricing a Home

Even with the perfect Comparative Market Analysis and a killer marketing plan, pricing a home is never a straight line. Questions always pop up from sellers, buyers, and even appraisers. Knowing how to handle these common bumps in the road is what separates a good agent from a great one.

Think of this as your playbook for those tough conversations. It's all about being prepared with clear, confident answers that protect your client's interests and keep the deal moving forward. When you can anticipate these questions, you build the kind of trust that lasts a lifetime.

What if the Appraisal Comes in Low?

This is the phone call no one wants to get, but it's far from a deal-killer. When an appraiser’s valuation comes in below the contract price, it creates a financing gap. The first thing to do is stay calm and get methodical.

Get a copy of the appraisal report immediately and go through it with a fine-tooth comb. You're looking for errors or oversights. Did the appraiser use a foreclosure as a comp? Did they completely miss that brand-new kitchen remodel? Simple mistakes, like incorrect square footage, can make a huge difference.

If you find legitimate problems, you can file an appeal, often called a Reconsideration of Value. Your appeal needs to be professional and packed with hard data. Include things like:

- Better Comps: Find at least three stronger, more relevant comparable sales that the appraiser might have missed.

- Factual Corrections: Clearly point out any mistakes in the report about the home's features, size, or condition.

- Market Context: Add a brief note explaining why your comps are a much better reflection of the home's true value.

A low appraisal isn't the final word; it's the start of a new negotiation. Your job is to build a logical, data-backed case to either challenge the number or guide everyone to a new solution that works.

If the appeal doesn't move the needle, you still have options. The buyer might bring more cash to the table, the seller could agree to lower the price to the appraised value, or you can negotiate a split where both sides meet in the middle.

How Do We Handle a Price Reduction?

Nobody loves talking about dropping the price. But in a shifting market, it's often a smart and necessary move. The trick is to have this conversation with your seller before the sign ever goes in the yard. Set the expectation from day one.

I like to call this the "14-Day Check-In." We agree up front that if we don't hit a certain activity level—say, 10 showings and at least one offer—within the first two weeks, we'll sit down and talk about the price. This approach reframes a price adjustment not as a failure, but as a planned response to what the market is telling us.

When it's time to have that chat, bring the data, not just your opinion. Show them the feedback from showings, new homes that have just hit the market, and recent price drops on competing properties. This data-driven approach takes the emotion out of it and reinforces your role as their strategic partner.

Should We Price High to Leave Room for Negotiation?

This is easily one of the most common and dangerous myths in real estate. Sellers often think that starting high gives them an edge in negotiations. The truth is, it does the exact opposite. Overpricing a home is the fastest way to get less money for it.

Here’s why: Today's buyers are savvy. They have access to the same data we do. When they see a house that’s priced 10% over the comps, they don't think, "Great, a negotiating opportunity!" They think, "Unrealistic seller," and just keep scrolling.

The first 2-3 weeks on the market are the golden window for a listing. That's when you get a flood of attention from the most serious, qualified buyers. If you miss that window because you were priced too high, you’ll end up chasing the market down with a series of price cuts, almost always selling for less than if you had priced it right from the beginning.

Turn your listing photos into captivating videos that justify your price and attract more buyers. With AgentPulse, you can create scroll-stopping video tours in just minutes, no editor required. Elevate your marketing and close more deals by visiting https://www.agentpulse.ai.